Why, indeed, have we been beaten? Because of the unawareness of the public regarding the issue: ignorance is therefore the enemy that we have to fight and to defeat, and in this very battle our weapon must be the truth, the only exact and only fruitful principle of the inalienable and imprescriptible right that is the right to exchange.

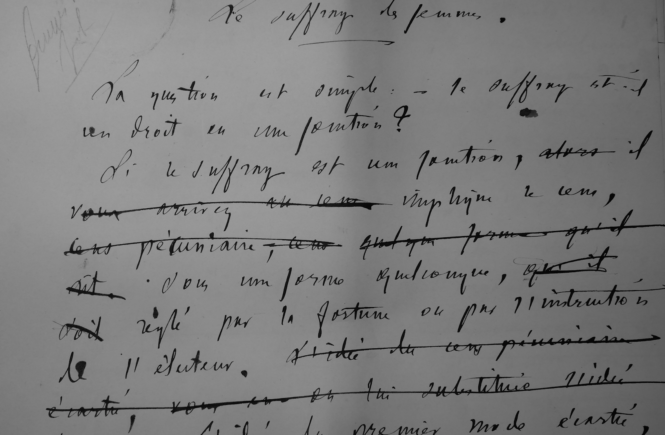

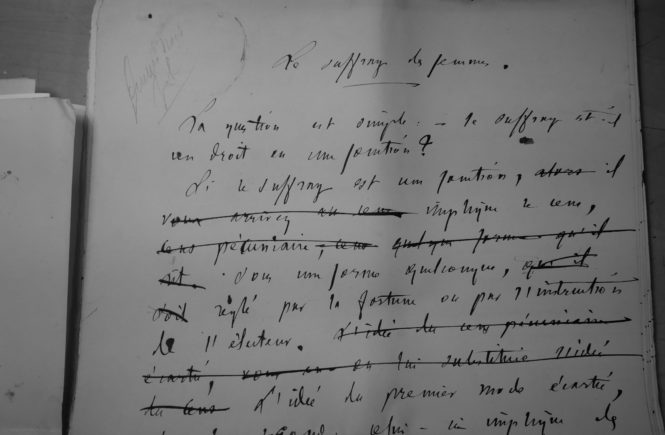

Yves Guyot on women’s suffrage (1879)

What is the argument of opponents of women’s suffrage? Their incapacity, their feeble mind, their ignorance! They proclaim, by this very fact, that universal suffrage is a function. Men are sole responsible for regulating it. They establish themselves as the sovereign judges of the aptitudes of those who are to fulfill it. They claim to be the only ones capable of doing so; all of them are capable; and being the strongest, they exclude all women. After having banned half the nation from that role, they pompously declare that they have established universal suffrage. It is the oligarchy of sex substituted for the oligarchy of money.

French classical liberals and the issue of women’s rights

It is tempting for a liberty-minded historian to leave untouched the comforting presumption that French classical liberals, who championed freedom for the individual in the 17th, 18th and 19th centuries, must have upheld women’s rights too. Contemporary studies, while often obliterating the role of men in the development of feminist rhetoric, have found occasionally in the history of ideas some remarkable advocates well ahead of their times, and they have offered them as objects of uncritical admiration, in a sort of reconciliatory carnival. One easily concludes that feminism was burgeoning in every century, and that the rising tide was lifting up all boats. […]

Yves Guyot, The causes of strikes (1893)

In a dry enumeration one cannot take into account the true causes of strikes, their justification, or the proportion between the risk to be run and the result to be obtained. We can only state certain facts, upon which we can base a rough estimate as to the psychology of strikes.

Yves Guyot, Protectionist postulates and economic realities (1905)

Every protective tariff means increased taxation. A country’s wealth cannot be increased by increased taxation. (W. Smart.)

2. A protective tariff ought to bring in as little as possible to the Treasury, since its object is to prevent the importation of goods.

It ought to bring in as much as possible to those who produce the protected goods.

3. The effect of a protective duty on any commodity is to raise the price, not only of the amount imported, but of the whole quantity sold in the country; it is a private tax placed upon consumers for the benefit of producers.

4. A protective duty increases the price at which the protected article can be purchased, and diminishes the purchasing power of the buyer to the same extent.

Yves Guyot, The Impotence of Socialism (1908)

The Socialist party cannot balance up a governmental majority without destroying government itself, for it cannot admit that government fulfils the minimum of its duties. When a strike breaks out, the intention of the strikers is that security of person and of property shall not be guaranteed; and they have been preceded, supported and followed in this by certain Radicals who, when put to the test, have been obliged to commit acts such as they have violently laid to the charge of preceding governments. Socialist policy represents contempt for law, and all men, whether rich or poor, have an interest in liberty, security and justice, for the private interest of each individual is bound up with these common blessings. Socialists despise them all.

Material on the French school of political economy

Pierre de Boisguilbert (1646-1714) Hazel Van Dyke Roberts, Boisguilbert: economist of the reign of Louis XIV, New York, Columbia University Press, 1935 “Boisguilbert: An Early French Economist“, 1873, Westminster Review Vauban (1633-1707) A Project for a Royal Tythe, or General Tax, which by suppressing all the ancient funds and later projects for raising the public revenues, and for ever abolishing all exemptions, unequal assessments, and all rigours and oppressive distraining of people, will furnish the government a fixt and certain revenue, sufficient for all its exigencies and occasions, without oppressing the subjects, London, 1708 (see also the 1710 edition) Richard […]